Christmas 2024 is now behind us, leaving a lasting impression as brands deployed a range of strategies to distinguish themselves during the holiday season. With millions of shoppers relying on Google Shopping Ads for their holiday purchases, only the most strategic advertisers managed to dominate Share of Voice (SOV) and establish themselves as leaders in their categories.

In this report, we tracked Google Shopping data and analyzed the top advertisers across six major categories—Apparel & Accessories, Automotive, Health & Beauty, Home & Décor, Music, and Wine & Liquor. These brands didn’t just win ad space; they strategically leveraged their strengths, innovative approaches, and holiday campaigns to secure a leading Share of Voice (SOV), ensuring they became the first choice for holiday shoppers.

Read More about GrowByData Insights:

- 8 Key Takeaways to Dominate Financial Services

- Amazon’s Halloween Surprise: A Strategic Retreat?

- Amazon Prime Day 2024: A Game-Changer Across Retail Categories

Let’s dive into the performance of these industry leaders and uncover the strategies that set them apart.

The Battle for Holiday Shoppers: Christmas 2024 in Review

As with every holiday season, Christmas 2024 highlighted the intense competition among brands striving for top visibility in Google Shopping Ads. Advertisers distinguished themselves by leveraging data-driven strategies, optimizing holiday promotions, customizing product offerings, and targeting audiences with precision. The result? A highly competitive landscape where only the savviest advertisers claimed their spot in the minds—and carts—of consumers.

Below, we explore the top three advertisers in each category and the tactics that helped them dominate.

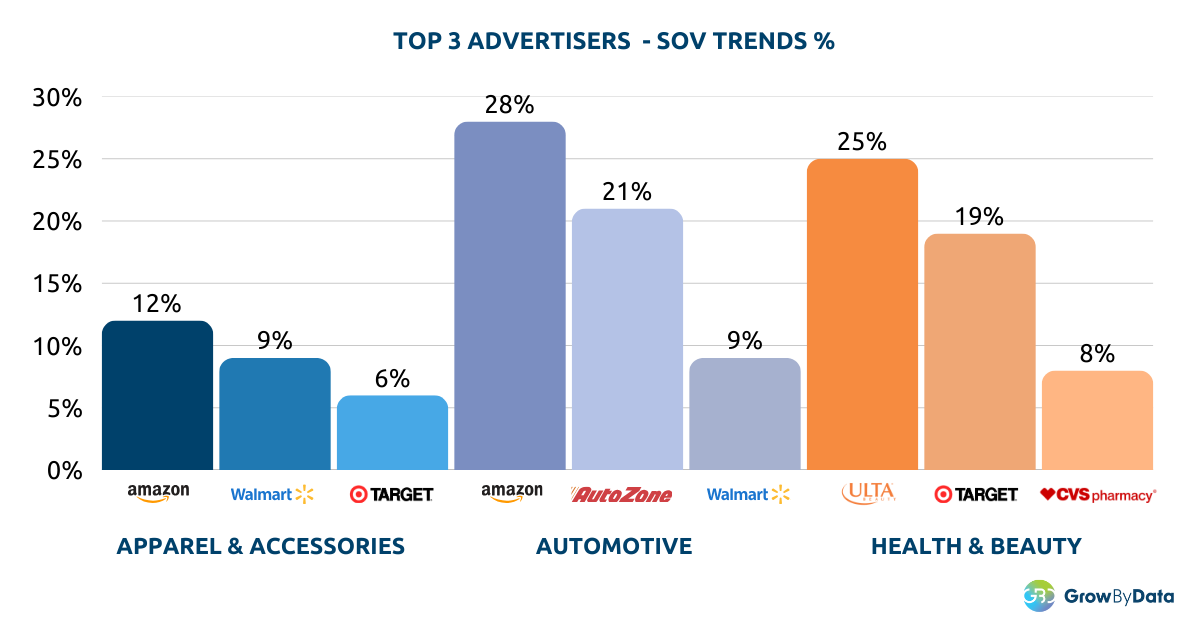

1. Apparel & Accessories

- Amazon leads with an 11.95% SOV, leveraging its expansive reach and strong e-commerce dominance.

- Walmart follows closely with 9.12% SOV, driven by competitive pricing and promotions.

- Target secures a 5.65% SOV, emphasizing its niche appeal in travel accessories.

Key Insight:

The apparel category remains highly competitive, with Amazon leading, followed closely by Walmart and Target.

2. Automotive

- Amazon dominates with a 28.39% SOV, showcasing its continued strength across diversified product categories.

- AutoZone comes in second with a 21.34% SOV, underlining its focus on automotive essentials.

- Walmart holds a 9.34% SOV, emphasizing its broad inventory appeal.

Key Insight:

Amazon’s dominance in the automotive category reflects its ability to cater to both niche and mainstream audiences, while AutoZone maintains a stronghold in specialized automotive products.

3. Health & Beauty

- Ulta Beauty leads with a 25.27% SOV, highlighting its focus on premium beauty products and targeted campaigns.

- Amazon follows with an 18.71% SOV, leveraging its broad inventory and holiday-centric promotions.

- CVS Pharmacy secures an 8.19% SOV, emphasizing its dual role as both a health and beauty retailer.

Key Insight:

Ulta Beauty’s lead demonstrates the power of specialization in beauty retail, while Amazon and CVS benefit from their diverse product offerings.

Let’s continue to explore the top 3 advertisers in the Home & Decor, Music, and Wine & Liquor industries.

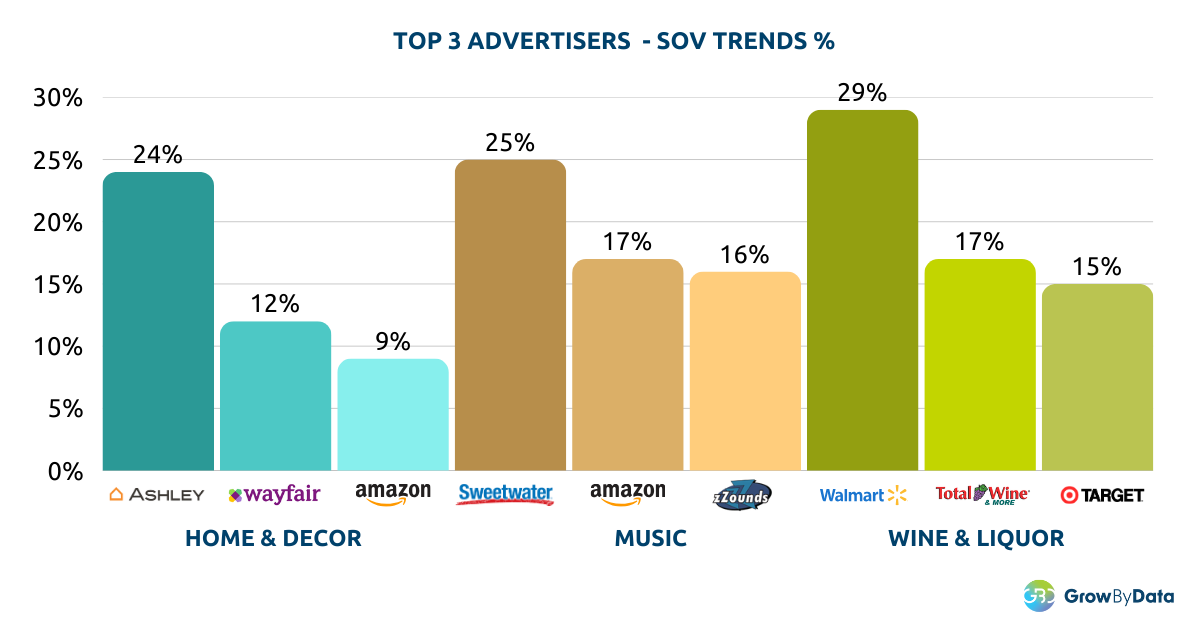

4. Home & Décor

- Ashley captures the top spot with a 23.64% SOV, emphasizing its dominance in furniture and home décor.

- Wayfair follows with an 11.94% SOV, showcasing its extensive online catalog.

- Amazon maintains a notable presence with an 8.91% SOV, reflecting its ability to compete across diverse categories.

Key Insight:

Home & Décor remains a competitive space, with Ashley and Wayfair focusing on furniture, while Amazon’s broad inventory keeps it in the mix.

5. Music

- Sweetwater holds a commanding 25.00% SOV, demonstrating its leadership in music equipment and instruments..

- Amazon, with a 17.17% SOV, continues to cater to a diverse audience with its expansive product catalog.

- zZounds, at 15.71% SOV, solidifies its position as a key player in the online music retail space.

Key Insight:

Sweetwater’s dominance reflects its specialization in music gear, while Amazon and zZounds compete for significant shares in the category.

6. Wine & Liquor

- Target leads with a 29.38% SOV, leveraging its holiday campaigns and strong inventory.

- Total Wine & More follows with a 16.83% SOV, emphasizing its focus on premium wines and liquors.

- Walmart secures a 14.83% SOV, catering to budget-conscious holiday shoppers.

Key Insight:

Target’s significant lead highlights its effective holiday strategy, while Total Wine & More and Walmart address different segments of the audience.

Conclusion: Strategies for Dominating SOV in Future Holiday Campaigns

The Christmas 2024 SOV analysis highlights how top advertisers leveraged category-specific strategies to dominate Google Shopping Ads during the holiday season. Amazon once again proved its mastery by combining broad reach with precision targeting and solidifying its dominance.

Take Apparel & Accessories, for example. Amazon didn’t just throw products online; they were strategic. They strategically balanced pricing, inventory, and shopper preferences. Meanwhile, Target didn’t try to compete everywhere; they found their sweet spot with travel accessories.

In Health & Beauty, Ulta Beauty was the rockstar. They delivered exceptional shopping experiences, while CVS and Amazon used variety and promotions to win big.

The real takeaway? It’s not about being everywhere – it’s about being smart. Brands that understood their strengths, targeted their audience precisely and moved early in the holiday season were the real winners. For businesses looking to crush it next holiday season, here’s the insider tip: Know your audience, be strategic, and create experiences – not just transactions.