Conspiracy theorists gather round! Is this a short-term play to boost earnings ahead of the close of Q2, or is this something else? Amazon did something similar in 2020, but that was a result of the economic headwinds from the pandemic.

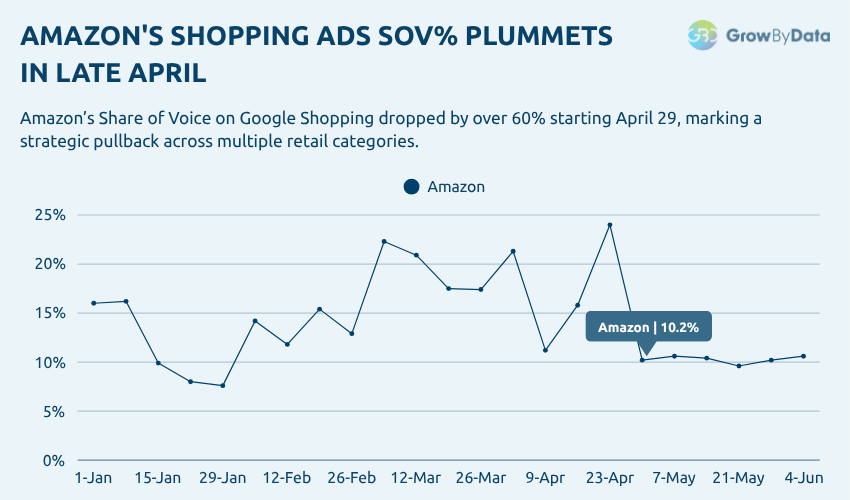

Once again, first reported by Mark Ballard, director of research at Tinuitti, Amazon has made a quiet but seismic shift in the Google Shopping ecosystem by dramatically scaling back its presence in major retail categories starting April 29, 2025. Far from a simple tweak, this was a deliberate and strategic withdrawal, one backed by clear evidence in the data.

We independently verified this through our cross-vertical data sets, and we can report that throughout the first four months of the year, Amazon maintained a commanding Share of Voice (SOV) on Google Shopping. However, as the end of April approached, its numbers took a sharp downturn. This sudden change opened a significant opportunity for competitors, who wasted no time stepping up to claim more visibility and influence in the space.

→ Monitor your presence in LLM platforms

Amazon’s Significant Pullback Across Retail Verticals

With GrowByData’s Paid Search Intelligence solution, we analyzed shopping ads from January 1st to June 10th. The detailed Week-by-week analysis highlights a measurable drop in Amazon’s Share of voice by over 60% across different retail industries.

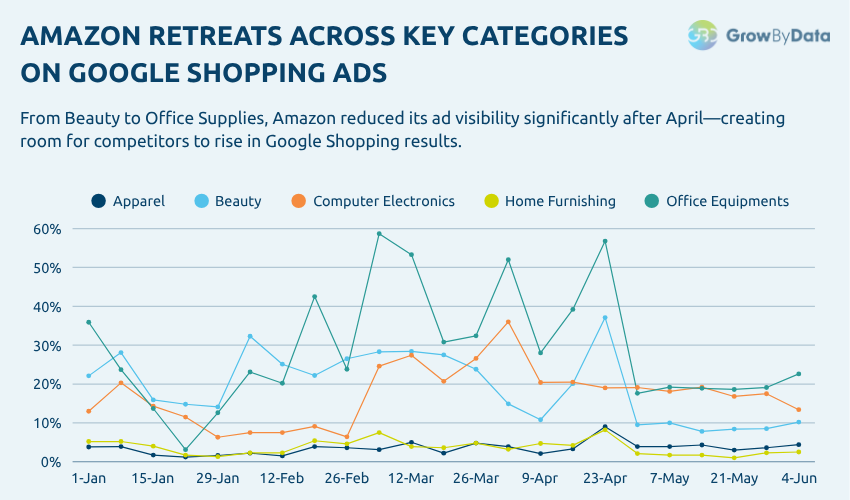

Here is the breakdown of Amazon’s SOV% drop in various industries.

| Industry | Amazon’s SOV Drop |

|---|---|

| Apparel | 🔻93.7% |

| Beauty & Personal Care | 🔻59.1% |

| Home Furnishings | 🔻50.1% |

| Computers & Electronics | 🔻18.6% |

| Office Equipment & Supplies | 🔻12.3% |

The data demonstrates Amazon’s use of a gradual, step-by-step pullback approach in Google Shopping Ads.

What Were the Effects?

- More Advertising space for competitors to grab opportunities

- With less competition, brands can lower CPCs and optimize their budgeting strategies

- Agile Advertisers will have a high chance of ROAS

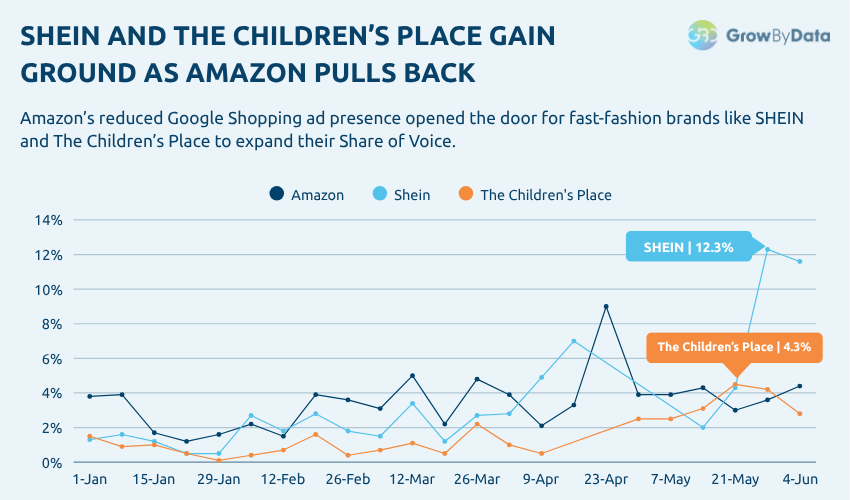

This massive drop in SOV did not go unnoticed. Some of the brands quickly adjusted to their advertising strategy, seizing the opportunity and substantially boosting their visibility in the market.

Strategic Brands Seizing the Opportunity

As Amazon’s market presence diminished, these leading brands executed ambitious campaigns to secure premium placement and expand their share of paid visibility:

| Brands | Category | SOV% Gain |

|---|---|---|

| SHEIN | Apparel | +139.2% |

| The Children’s Place | Apparel | +67% |

| Target | Beauty & Personal Care | +324% |

| Wayfair | Home Furnishings | +231.8% |

Apparel: SHEIN and The Children’s Place Seize Market Opportunity

As mentioned above, with Amazon’s reduced presence or their strategic pullback on Google shopping ads in the apparel industry, SHEIN and The Children’s Place saw opportunities and executed planned and tailored advertising campaigns. As results, both brands saw massive growth in their SOV%.

- SHEIN harnessed its broad product variety and paid media strategy to boost its Share of Voice (SOV) from roughly 4.9% to over 11% – a 139.2% relative increase. Its agility in adjusting to market changes positioned it as a leader in apparel visibility following Amazon’s retreat.

- The Children’s Place, historically a niche contender, delivered significant results by increasing its SOV by 67%. The brand took advantage of lower auction competition to establish dominance in the kids’ apparel segment, outpacing larger rivals that were slower to adapt.

Take a look at these articles:

→ How Temu is Challenging SHEIN’s Dominance.

→ How The Children’s Place Leveraged Advertising for Back-to-School 2024.

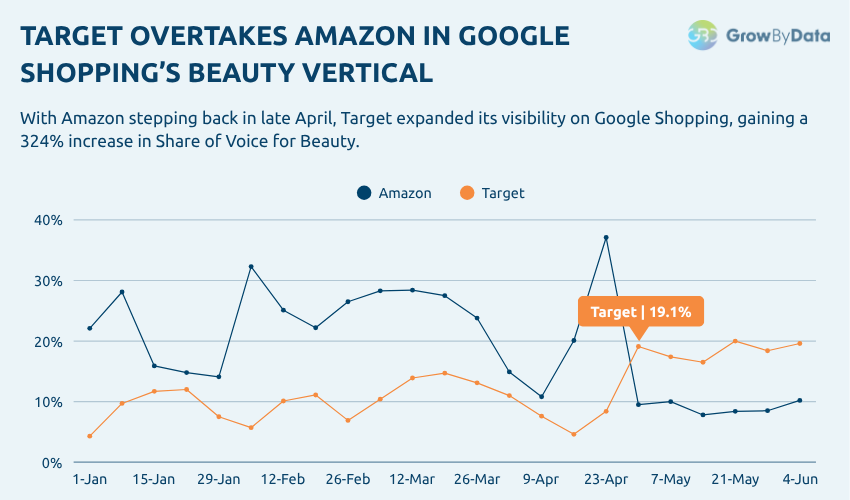

Beauty & Personal Care: Target Capitalizes on Amazon’s Withdrawal

In the beauty and Personal care industry, Target executed a strategic advertising/paid search campaign with a decline in Amazon market share. With such quick response and strategic paid search campaign, Target grabbed this opportunity to reinforce its leadership position.

- Target’s Share of Voice (SOV) experienced a dramatic rise from 4.6% to nearly 19.6%, representing a 324% increase as the retailer swiftly filled the competitive gap left by Amazon’s retreat.

→ For insights into the shifting dynamics in the beauty sector, explore Beauty’s Digital Battleground in Google Shopping Ads.

Home Furnishings: Wayfair Takes the Lead

Wayfair seized the strategic opportunity presented by Amazon’s reduced presence in home furnishings, converting a competitive gap into a decisive leadership position.

- Wayfair Share of Voice (SOV) surged from 5.1% to 17.0%, a remarkable 231.8% increase outpacing all other major furniture retailers and solidifying its dominance in the category

Strategic Implications for Retail Marketers

Amazon’s recent and significant pullback from Google Shopping has not only transformed the search engine results page (SERP) but also redefined the economic landscape for paid retail advertising.

Key Shifts:

- Expanded Share of Voice (SOV): Amazon’s competitors are now capturing a high SOV % and paid search visibility across key retail categories as mentioned above.

- Reduced Cost-Per-Click (CPC): With Amazon’s strategic pullback on Google Shopping ads, Google auction pressure, CPCs have a high chance of decrement, and most importantly, improving cost efficiencies for these competitors.

- Enhanced Return on Ad Spend (ROAS): With improved visibility and higher conversion rates, agile advertisers are realizing stronger returns on their investments.

This is not a minor fluctuation; it represents a fundamental realignment of paid search dynamics, particularly in Beauty, Apparel, Home, and other high-value verticals.

Actionable Steps for Performance Marketing Leaders

If you are responsible for performance marketing or product listing ads (PLA) campaigns, immediate strategic action is required:

- Conduct Weekly SOV Audits: Monitor your Share of Voice by category and device to identify new opportunities and track market shifts.

- Activate Aggressive PLA Strategies: Prioritize categories where Amazon has pulled back its PLA strategies, deploying targeted campaigns to capture newly available market share.

- Optimize Product Feeds and Bidding: Ensure feed hygiene and refine bidding tiers to secure above-the-fold placements and maximize visibility.

- Monitor Competitive Movements: Stay attuned to competitor strategies, as other brands are rapidly adapting to the changing landscape.

→ As Amazon Prime Day approaches, the brand needs to adjust its paid advertising strategy. Here is the detailed breakdown of Amazon Prime Day advertising strategies: Amazon Prime Day in 2024

Conclusion: Capture Your Paid Search Market Opportunity

Amazon’s exit from key categories opens up prime advertising space. Don’t let your competitors take the lead; leverage GrowByData’s search intelligence software to ensure your brand stays ahead.

If you are looking to grab such opportunities and see how you can maximize your market SOV% in this shifting retail landscape, contact our expert today.