These are tough times for everyone. With the number of COVID-19 cases rising, most cities on lockdown and everyone practicing social distancing to control spread of the virus, we’re all feeling the pinch. Virtually all non-food related businesses have closed their physical stores for the safety of customers and employees, including industry powerhouses like Nordstrom and Saks Fifth Avenue. Naturally, e-Commerce is expected to boom in this type of situation, so the focus for most companies is now certainly online sales. One harbinger of that focus is that Amazon has predicted such a spike in online deliveries that it plans to hire 100,000 workers.

Challenges For Online Fashion Stores

However, the current situation is not favorable for fashion retailers on the online front either — for two reasons. First, while the pandemic wreaks havoc on people’s plans, fashion categories see an expectedly lower online demand against high competition. GrowByData also has recorded negative growth rate (-1%) in the Apparel & Accessories Industry over last three months, although this is likely a normal slowdown after the holidays.

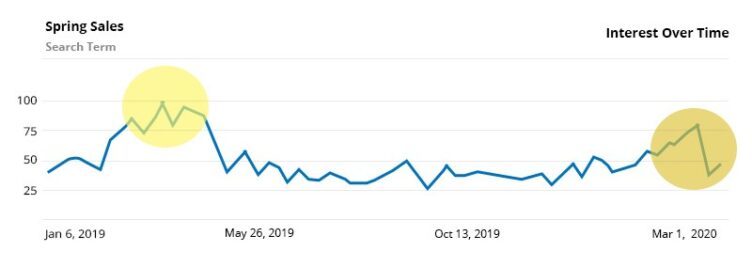

Currently, consumer’s online shopping preferences are the essentials like food, beverages, health care and medicine. These online industries are seeing huge sales growth rates. Google also has recorded the highest worldwide search interest related to groceries as searches related to fashion have slowed significantly. By contrast, consumers’ interest in “Spring Sales” was at its peak at this time in 2019, whereas the current season is showing only moderate fashion search interest, which we can assume is due to the COVID-19 crisis.

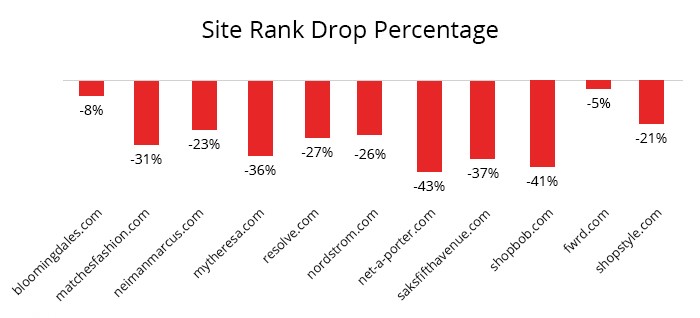

Also, per Alexa,online grocery stores like Peapod.com (+56%), FreshDirect.com (+72%) and Kroger.com (+14%) have seen surging website ranks in the last 90 days while online traffic for leading fashion retailers has dropped significantly worldwide. The chart below shows the website rank drop percentage of the top online fashion stores that we have analyzed:

How Are Leading Online Retailers Responding?

More Products Online

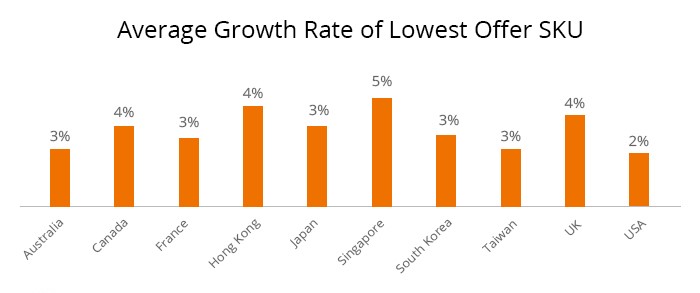

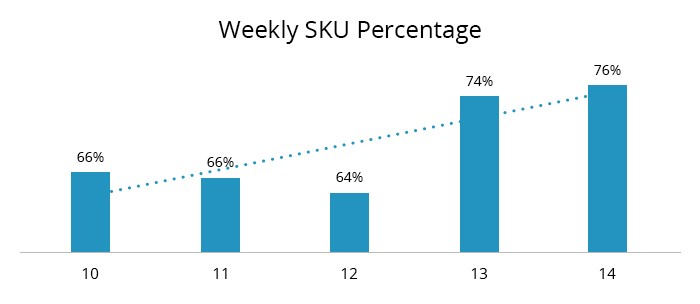

The first response we’ve noticed is an increase in online product availability. We at GrowByData have been monitoring 974 fashion brands in 91 different categories with a total SKU count of 30,260 from the past year on a daily basis. We have matched those SKUs to variant levels in the retailer’s online store. We have been tracking the products and their prices directly from these online stores originating in 10 different countries — the U.S., the UK, Canada, Australia, France, Hong Kong, Japan, Singapore, South Korea and Taiwan — to glean a global perspective.

In the last five weeks, we have noticed that these retailers have been increasing the number of products available online, as shown in the graph below:

Discounts And Offers

Another response has been incentivizing online shopping. In tense times, a common retail strategy is to attract customers with good offers. With physical stores closed, the only logical move is to push online sales to clear any inventory pile-up with good discounts.

Here’s a sample of current sales and deals online fashion retailers are floating: MatchesFashion.com, MyTheresa.com and SaksfifthAvenue.com are offering 15% to 25% discounts sitewide. Nordstrom.com and Neimanmarcus.com currently offer a 40% discount on sale items with free shipping and returns. Bloomingdales.com is offering 20% to 60% discounts on selected items, Revolve.com is offering free shipping and shopbop.com offers sales of up to 70% off, free express international delivery and easy returns.