In the first half of 2025, Google’s apparel search results shifted dramatically. AI Overviews gained momentum, Merchant Listings surpassed traditional organic results, and agile challengers captured share from legacy retailers.

Our benchmark analysis tracks 1,000+ apparel keywords daily across Google Search, Shopping, and AI-driven results, giving brands and retailers a clear view of how visibility is evolving.

Key Findings at a Glance

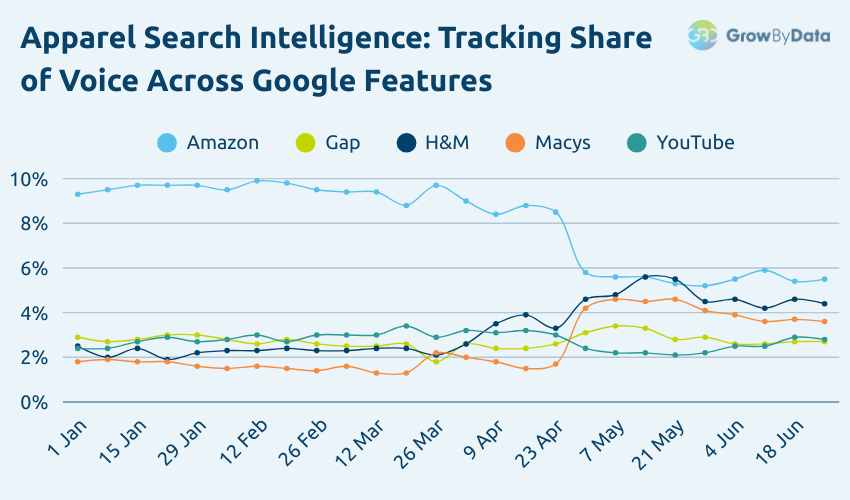

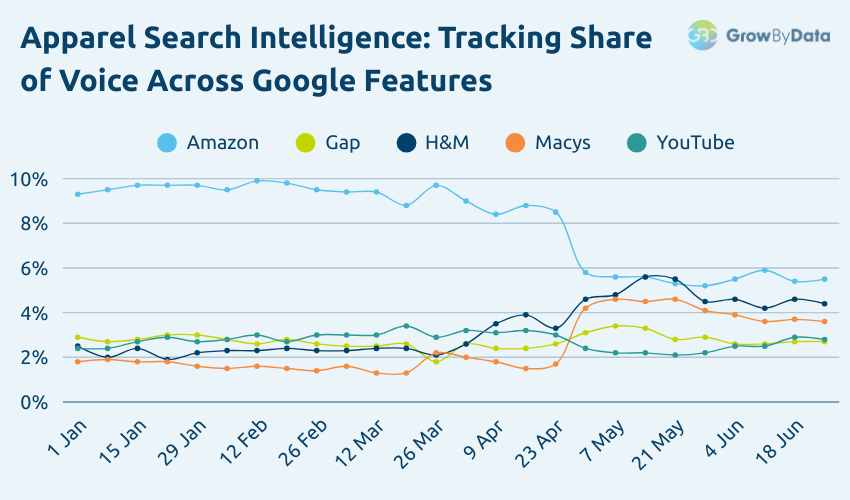

- Amazon slips: Still #1 with 7.6% Share of Voice, but down -26% in visibility.

- Retailers rise: H&M (+42%) and Macy’s (+63%) surged through smarter Merchant Listings.

- Fast-fashion challengers dominate: Shein (+510%) and CurveDream (+1,500%+) exploded in Shopping Ads.

- Editorials lead AI: YouTube (4.9% SOV), Reddit (4.0%), Quora (3.6%) top AI Overviews. Most retailers are absent.

- Shopping Ads Volatility: Net-A-Porter spiked +813% in Q1, while Shein grew +510% in Q2, showing rapid turnover in ad-driven visibility.

- Search real estate shifts: Merchant Listings overtook organic results for apparel queries.

Takeaway: Winning in 2025 means controlling Above-the-Fold across every format: feeds, Shopping, AI, and editorial.

How We Measure

Our SERP Intelligence Platform tracked:

- 1,000+ apparel-related keywords tracked across Google’s SERPs in Q1 & Q2 2025.

- Share of Voice (SOV) indexed by placement and Above-The-Fold (ATF) visibility.

- 20+ SERP features, including Shopping Ads, Merchant Listings, Organic, Text Ads, AI Overviews, Editorials

- Normalized comparisons across brands and retailers

GrowByData’s methodology ensures that results reflect true competitive visibility, not just rankings.

What the Data Shows

Challenger Brands Overtake Legacy Players

Feed-driven challengers like Shein and CurveDream grew exponentially in Shopping Ads visibility, outpacing legacy retailers like Gap and Nordstrom. This signals a shift toward agile, digital-native strategies.

Shifts in Search Real Estate

By mid-2025, Merchant Listings surpassed Organic results in exposure across apparel queries. Brands optimizing product feeds gained a disproportionate share of Above-The-Fold space.

Editorial Content Shapes AI Overviews

Platforms like YouTube, Quora, and Reddit dominate AI Overview citations. However, these placements are fragile, with high volatility and low ATF presence, posing risks for brands relying solely on editorial mentions.

Why It Matters for Apparel Brands & Retailers

- Visibility ≠ Conversions: High SOV without ATF presence risks wasted exposure.

- Volatile Formats: AI Overviews and Shopping placements shift weekly; relying on one channel is risky.

- Opportunity for Agility: Mid-tier brands that adapt feeds, markup, and media rapidly can capture share from slower legacy players.

Who Should Download This Report?

- Retail CMOs & Digital Leaders: Stay informed of latest SERP trends and benchmarks for strategic planning.

- SEO, SEM & eCommerce Pros: Get a granular view of apparel-specific ranking factors and winning tactics in 2025.

- Market Intelligence Teams: Use proprietary data to guide investments and defend competitive positions.

Preview of the Full Apparel Benchmark Report

Inside the full 15-page benchmark, you’ll find:

- Complete SOV rankings across 100+ retailers and platforms.

- Trend charts showing weekly gains/losses by brand.

- Strategic recommendations for maintaining AI and Shopping visibility.

- Risk analysis for over-reliance on volatile SERP features.

| Brand |

SOV% |

Q1-Q2 Change |

| Amazon |

7.6% |

-26.1% |

| H&M |

4.2% |

+42% |

| Macy’s |

3.8% |

+63% |

| SHEIN |

2.9% |

+510% |

| Curve Dream |

1.5% |

+1,587% |

Get the Complete Benchmark Report

This summary is just a preview. The full report includes brand-by-brand analysis, detailed charts, and actionable strategies for apparel marketers.