In today’s hyper-competitive landscape, understanding what your competitors are doing in search isn’t just an SEO tactic—it’s a strategic advantage. From uncovering promotional timing and pricing shifts to identifying which resellers are boosting competitor visibility, leading brands are using search intelligence solutions to inform decisions across marketing, merchandising, pricing, and channel strategy.

Here’s how they do it.

1. Detecting Competitor Pricing Shifts and Promotions in Real Time

Search monitoring reveals more than keywords—it uncovers price movements, promotion schedules, and bundling tactics used by competitors.

For example:

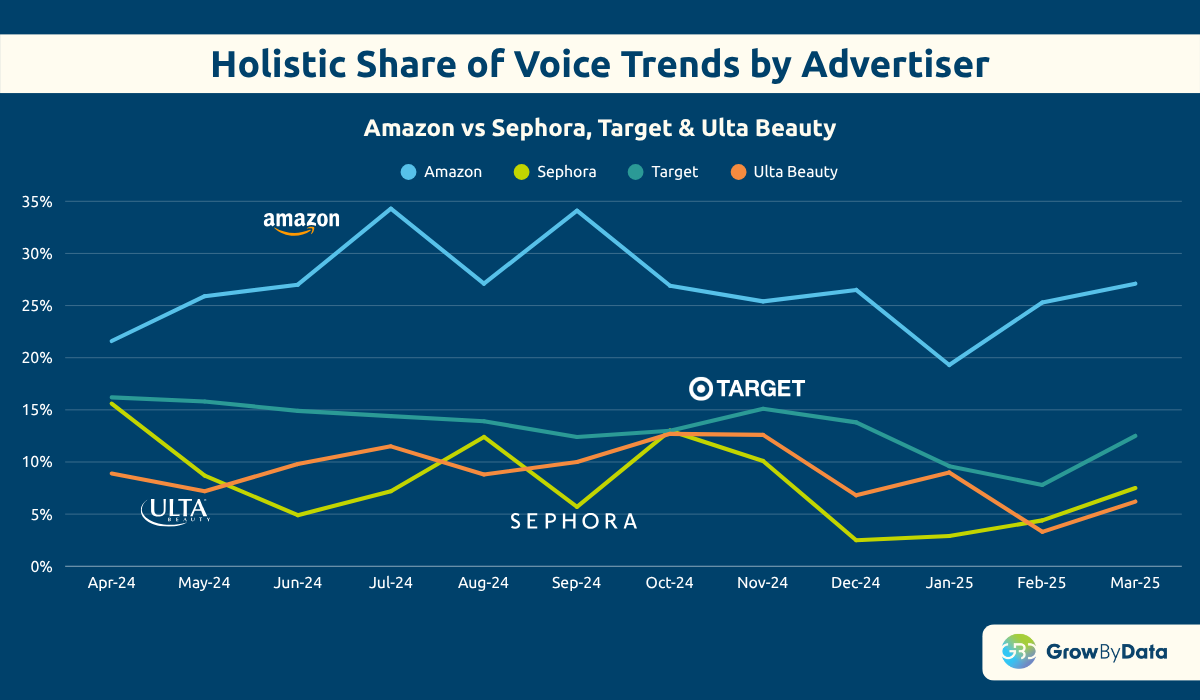

- Amazon’s Share of Voice spikes around Prime Day, indicating aggressive seasonal pushes.

- Brands like Estée Lauder gain competitive lift by offering free gifts or exclusive bundles—often visible only through SERP ad units or Google Shopping insights.

- YesStyle leverages a mix of price drops annotations, expedited shipping, and frequent promotions to gain traction in cosmetic subcategories.

This data becomes a proxy for competitor revenue strategy—allowing you to benchmark against and respond in real time.

2. Surfacing Product Strategy Through Search Trends

Search visibility also offers a lens into product evolution:

- In apparel, brands like Calvin Klein have shifted promotional focus from darker suits to lighter tones, suggesting a trend change.

- Monitoring changes in ad creatives and search product listings allows brand and category managers to detect micro-shifts in merchandising that could signal larger trends.

3. Uncovering Reseller Influence on Brand Visibility

A key insight surfaced in the webinar was the power of resellers—and how they shape brand prominence in search:

- Target has been heavily favoring E.L.F. Cosmetics in its promotional slots, which significantly elevates the brand’s visibility across Google Shopping and local SERPs.

- This highlights the importance of knowing who is carrying your brand and how prominently they feature it.

Brands that proactively monitor their reseller coverage can influence trade budgets, optimize co-op ad strategies, and align incentives to boost visibility where it matters most.

4. Geographic & Channel-Level Visibility Intelligence

Search data offers granular insights—not just national trends:

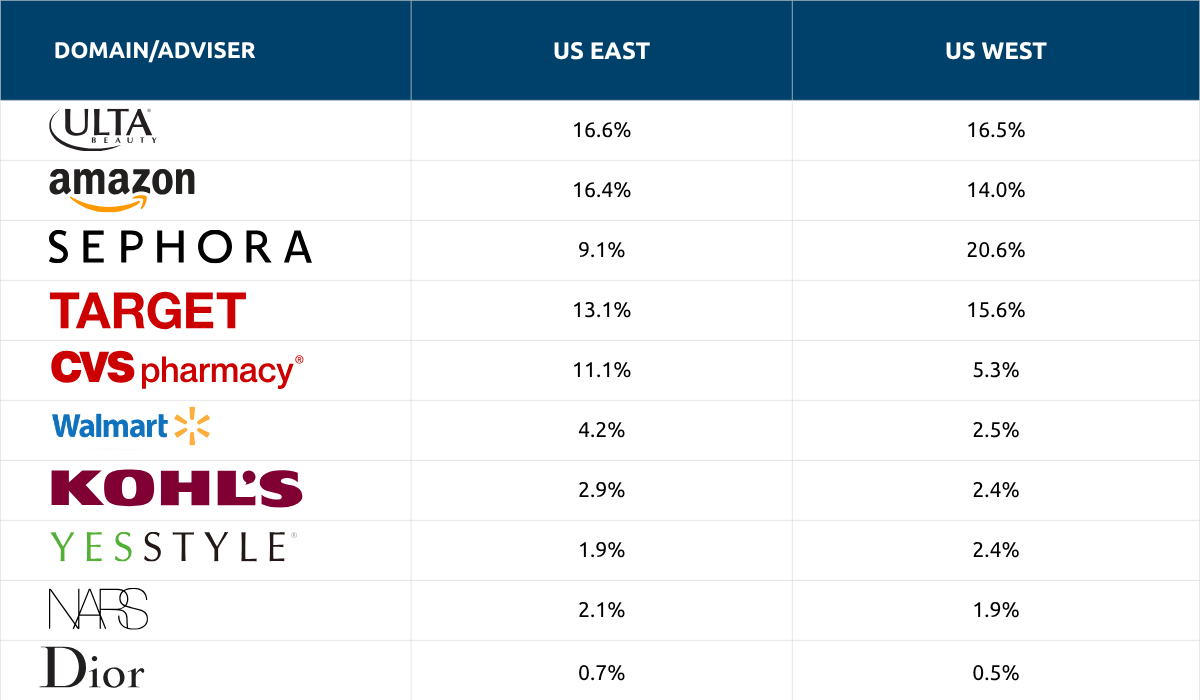

- On the East Coast, Amazon and CVS dominate cosmetic visibility.

- On the West Coast, Target and Sephora outperform in many local markets.

- Google SERP features and Google AI Overviews now vary dramatically by region, device, and search intent—meaning that local SERP leadership is a critical dimension of search visibility strategy.

Tracking share of voice by metro, DMA, or ZIP code provides actionable insights for regional performance teams.

5. Understanding AI Visibility: The New Competitive Frontier

One of the most urgent shifts discussed was visibility in AI Overviews:

- Google’s AI-generated results surged from single-digit to 60–70% page dominance in some verticals.

- Brands like L’Oréal were consistently surfaced in AI responses, while others like Estée Lauder and e.l.f. were notably absent.

- AI visibility requires content designed to be machine-readable and semantically rich, blending traditional SEO with emerging LLM optimization.

6. Strategic Takeaways for Competitive Leaders

Modern competitive intelligence teams are using search data not just for campaign optimization—but to inform:

- Pricing strategy in light of competitor adjustments

- Merchandising focus based on product positioning

- Trade promotion alignment with top-performing resellers

- Localized media and inventory decisions based on geographic gaps

- AI readiness assessments as search evolves

Final Thought

As search behavior fragments across traditional SERPs, Shopping, YouTube, Reddit, and AI tools like Gemini or ChatGPT, brands that invest in search monitoring will outperform. The leaders aren’t just tracking what’s ranking—they’re decoding why, where, and how it’s impacting market share.