Dynamic pricing is a valuable yet misunderstood and under-utilized concept in Pricing. Some retailers dynamically reprice while others are reluctant for the fear of a race to the bottom. If done right, a dynamic pricing strategy unlocks an enormous competitive advantage.

Dynamic pricing provides an enormous strategic advantage to boost revenue.

Our winning customers and partners use our data to do dynamic pricing and win the eCommerce sale and return on ads. Per Bain, top performers are twice as likely to reprice. On the contrary, if unmanaged, it can be disastrous. If you allow automated repricers without setting up proper business rules, it will most likely result in erroneous data and lost revenue.

As a retailer, you may ask – how should you tactically and dynamically reprice for e-commerce? How should you dynamically price across your marketplaces like Amazon, Walmart, Google Shopping, and Target? How should you sync prices on your eCommerce sites like Shopify, BigCommerce, Magento, 3DCart, Yahoo, and others? How should you dynamically reprice across different countries and cities within countries? Here are our Top 5 suggestions –

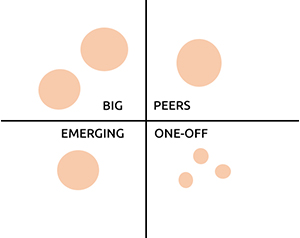

1. Proactively Understand Strategy of Your Cluster of Competitors

You must cluster your competitors to create the right dynamic pricing strategy. If you are a global brand, you compete only with your peers and emerging brands. You don’t compete with one-offs resellers and small sellers. For example, if you are DSW, you compete with Foot Locker, Zappos and directly with the shoe company’s DTC business. You don’t compete with the one-off eBay sellers. You want to look at the reseller assortment and keep a pulse on your cluster of brand and retailer competitors.

2. Only Trust High Quality SKU Level Pricing Data to Feed Your Models

Match your SKUs to exactly the SKUs of your competitors at a product variant level. A Nike Air Jordan White size 9 shoe cannot be compared to a size 8.5. Likewise, a new product SKU must be compared with competitors’ new SKU and not refurbished. This is a hard problem to solve and one of the many reasons why Price Intelligence is complex. Beware of repricers that don’t give SKU-level matching at a variant level.