Understanding what keywords your potential customers use for their search queries in search engines and the intent behind a user’s query is very crucial. Doing keyword research the right way and being aware of the buyer’s journey through critical thinking is an important part of Search Engine Optimization (SEO). The buyer’s journey includes the phase of attraction to awareness to consideration and finally conversion. Categorizing the keywords in this fashion requires a funnel approach, as a result of going from broad subjects to more specific thoughts.

Table of Contents: Show

What is a Keyword Funnel?

A keyword funnel refers to using the keyword searches by users and categorizing them into the stages of where a user might be in their purchase journey (also known as a purchase funnel). These funnels help categorize keywords based on popular search terms as part of a keyword research technique.

Keyword funneling helps to identify a need for particular search terms people type into search engines to engage users who need specific information. You can include them strategically in your content so that your content appears higher on a search engine results page (SERP) or SERP features like “Google Popular Products“, “People Also Ask” and “Featured Snippets“.

For instance, “shoes”, is an extensive and general keyword. It can be narrowed down to “men’s white shoes” and become even more specific with “men’s size 10 white Air Jordans”. These types of searches are meant to understand the intent behind a user’s query. Each of these three searches shows that the user is in a different stage of their buying process.

What are the Stages Of The Keyword Funnel?

Most buyers go through different processes and stages before purchasing a product or service. The keyword funnel includes the process of carrying out multiple searches until they reach the point of conversion. A consumer’s search query varies by the stage of the buying decision process they are in. The process starts with a need or wants, followed by research and information gathering, then considering their options in the marketplace before finally deciding to purchase the product or service.

The keywords can be categorized into three stages of the buyer’s purchase process.

- Awareness

- Consideration

- Conversion

-

Awareness

This stage is all about building brand and product awareness. In this stage, the journey of customers from encountering your brand to conversion begins. The initial broad search keyword means they are in the initial “research” or “awareness” stage.

People in the awareness stage often use “issue or opportunity” terms and informational queries searching for general information. Customers at the awareness stage are aware of their needs and are beginning to seek information and do research for a product or service.

-

Consideration

The consideration stage is when people actively search for the solution to their problems although they are not actually taking action to purchase the products or services. The buyer moves from the research phase to considering potential solutions and evaluating their options.

At this point, users examine your website, compare alternatives, or interpret third-party reviews from many choices for the services or products they seek. Customers who have made it to this stage are valuable for your business as they are possibly ready to purchase something that your business offers.

-

Conversion

The final stage is about giving prospects a reason to buy your product, sign up for your service, or take any other action you desire. As your prospects move through the consideration phase, they find the solution and usually become ready to purchase a product.

These types of query search or long-tail keywords show the user knows what they want and that they have a strong intent to buy. The goal at this stage is to take the relationship to a mutually satisfying closed sale.

Search Intelligence to Empower Your Keyword Funnel Strategy

One of the most difficult things to do in marketing is to move the consumer through the various stages of the funnel. Before a consumer is ready to purchase, they evaluate their options, and before that, they have to be aware of their wants/needs and the plethora of products and services that could fulfill their needs.

Businesses need to create an environment that facilitates and guides the shoppers through these stages of the funnel. You need to utilize powerful online marketing intelligence tools that can provide granular data and visibility into your keywords, competitors, advertisers, prices, paid and organic listings, SERP features, etc. across the funnel stages. Deep strategic insights like this will help you understand where you are thriving and where you may be lagging. Thus, allowing you to make the right decisions and strategies to improve your performance at each funnel stage and consequently improve your impressions, clicks, and conversion across the digital shelf.

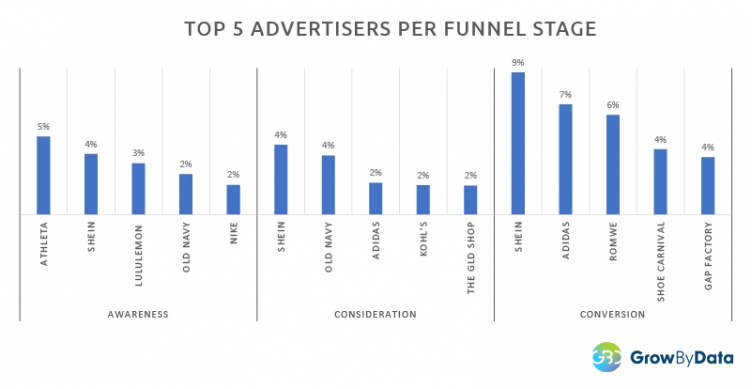

Using the Search Intelligence software, we collected granular data on 302 search keywords from the “Apparel and Accessories” category. We categorized them into three stages of the buyer’s purchase process: Awareness, Consideration, and Conversion to perform a comparative analysis. Here are a few types of insights that can be gained from our tool.

1. Competitive Dynamic by Funnel Stage

Analyzing the 4K distinct advertisers, we found that 57% of them were competing for the awareness funnel stage keywords, 75% competing for the consideration stage keywords, and 16% competing for the conversion stage keywords.

We wanted to find out which advertisers were the most prominent at each funnel stage. The graph below shows that “Shien” was among the top five advertisers for all three funnel stages. “Old Navy” was among the top 5 of the first two stages but not in the conversion stage keywords.

This means that they could drastically improve their sales and conversion by optimizing for the conversion stage keywords as they already have good impressions on the awareness and consideration stage keywords.

2. Regional Competition Analysis by Funnel Stages

The Search intelligence tool allows you to see your performance vs your competitors at a regional level based on keyword impressions per funnel stage, competitors at each stage, and content of the product ads per funnel stage.

The graph below shows that ROMWE has a good presence (7%-8%) in the conversion phase in three regions except for California, where they have a low presence (1%). This presents a great opportunity for them in California.

This type of regional intelligence insight helps businesses decide which region to focus their efforts on for specific funnel-stage keyword targeting.

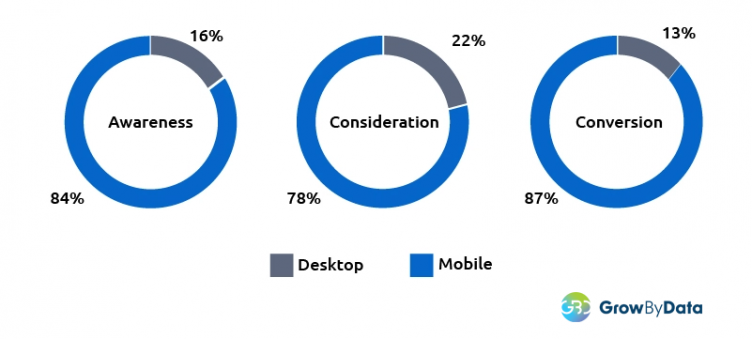

3. Funnel Stage Visibility by Devices

Having visibility on each funnel stage keywords by devices gives you insights into what stage keywords need improvement. The graph below shows that the majority of the impressions in all three stages for Apparel and Accessories keywords came from mobile devices. This reinforces the importance of optimizing your content and listings for mobile devices in this category.

Strategies For Each Keyword Funnel Stage

It is important to gain visibility in every stage of the funnel to convert users from the top of the funnel stages to the mid-funnel to the bottom of the funnel. Each phase of the funnel requires its own strategies to keep prospects moving from one stage to the next. The various strategies to be followed to move the buyer to the next stage of the funnel are described below.

Top of the Funnel

At the top of the funnel stage, you should try to capture your potential customers and increase your traffic, as there are few to no conversions in this stage.

Specifically, Top funnel keywords refer to general phrases or keywords that users search for when they are looking for any information. These keywords possess a high search volume and are targeted toward a broader audience.

1. Build SEO strategies

Your SEO can be the right channel to target low or broad-intent keywords from users to build awareness in this stage. You need to target those keywords with blog content and optimize for awareness keywords to bring in enough organic search traffic. You need to build high-ranking content using informational queries that encourage prospects to learn more about your product or service.

2. Paid Advertising

You can use paid ads to maximize brand awareness for low-intent keywords that triggers ads in google search. You can run ad campaigns on social media and in podcasts that are relevant to your target audience. By targeting low-intent keywords in Google Ads you can increase the chances of your brand visibility at the earliest stage of the consumer journey at the top of the results page. Instead of competing for high-cost keywords use tactics like remarketing lists for search ads (RLSAs) to target the customers to maximize ROAS.

3. Use Social Media Platforms

Social media platforms are a powerhouse for building awareness. You can get on popular social media platforms like Facebook, Twitter, and Instagram and share a post that highlights your unique selling proposition (USP). You can frequently organize digital awareness campaigns that aim to impact wide audiences that indicate possibilities to become new customers. Use visually engaging content such as videos, short blog posts, and social media posts to introduce your company and emphasize your brand story.

Middle of the Funnel

In this stage, you should focus on grabbing the user’s attention and boosting your engagement rate. You need to get your products in front of the customers providing them reasons to buy specific products from you as people in this stage compare alternatives.

Middle funnel keywords have moderate search volumes and are descriptive phrases and they are researching and comparing their options to purchase any products or services.

1. Target High-Intent Keywords

You need to focus on users who show specific intent to purchase by using navigational queries. You can segment your audience and create highly targeted campaigns to target specific user interests, based on their actions on your websites, ads they clicked, the landing page they visited, etc. Also, you can create landing pages specific to individual customer segments.

2. Nurture Leads

You might offer incentives like free trials, competitor comparison guides, demo videos, and product samples to nurture leads into becoming paying customers. You can also use email marketing channels for reaching existing leads and guiding them from one stage to another. If you have a prospect’s contact details you can send email content such as product descriptions or even blog posts that target relevant search queries, customer testimonials, and tips that provide valuable content for users.

3. Boost Engagement

You can create quality content such as case studies, and video tutorials, write an article, or white paper, answers a question, and solves a problem for your potential customers. You can generate interest by inviting visitors to participate in a survey to learn more about your brand, share case studies and product guides, run a free trial program or offer product samples. Also, you can run a Google display ad campaign which tends to be more effective for the middle of the funnel.

Bottom of the Funnel

In this funnel stage, you need to focus on exact or high-intent keywords and specific goals to increase your conversions. The goal here is to convert leads, minimize conversion barriers and turn consideration into action. The bottom funnel keywords are the phrases or queries that signify the user’s intent to make a purchase and indicate their readiness to buy products or services.

1. Paid Search Campaigns

Paid search strategy includes improving quality ads, landing pages, conversion rates, and remarketing campaigns with paid ads which is beneficial to your ad Quality Score and overall PPC performance. You can create Google Ads campaigns including your competitor’s brand/product names as keywords to capture leads. Also, target keywords that indicate immediate purchase intent which suggests a user is ready to decide.

Use tools like Google keyword planner and your own reviews to find and bid on long-tailed keywords that can drive more qualified prospects to your website. In this stage, there are more specific search terms with strong buying intent for which you can bid more aggressively willing to get more clicks and rank on the search result page. As it is a branded search for a specific brand, we can have an extremely high conversion rate and the most likelihood of getting a sale.

2. Organic Campaigns

Focus on targeting new leads and users who are ready to convert by creating organic content that answers questions and eliminates any doubt potential customers may experience. You can provide free trials, guides, demo videos, and product samples so prospects can experience your product or service. You can share customer reviews of your product to build trust and incorporate customer testimonials to rank organically for people ready to convert.

You can create downloadable PDF content, add a Call to Action (CTA) to relevant resources, and send actionable emails. Also, keep pricing and feature instructions easy to access and understand.

Benefits of Using Keyword Funnels in Your Digital Marketing Strategy

- You can use top-of-the-funnel keywords to generate leads and familiarize a large audience with the brand.

- Top funnel keywords provide opportunities for link building. It is the best possibility for linking and getting backlinks as it covers more general topics. As a result, the information can more easily be connected to a variety of other pages organically.

- Mid-funnel keywords allow comparison shopping and prepare the consumer on how to compare products and choose the best.

- Bottom-of-the-funnel keywords is optimized to earn conversions turning visitors into customers or qualified leads providing an opportunity for organic links considered an essential part of SEO.

Conclusion

The key to an effective funnel is understanding your customers. As a retailer or business, it’s important to understand a potential customer’s buying process and to target customers at each stage. The keyword funnels help to guide prospects through each stage of the customer journey.

Search Intelligence tool can provide granular-level ad data to empower keyword funnel strategy. This tool collects paid and organic listing content from multiple locations in near real-time and provides a competitive landscape of strategic keywords that can be grouped to perform a comparative analysis by funnel stage.

Actionable insights and metrics from search intelligence help in the decision-making process for retailers and businesses to align their keyword strategies with the potential customer’s buying decision process. It helps to build a better funnel providing the ability to optimize campaign strategies to increase conversions as a result.