In the highly competitive retail industry, keeping your product’s price stagnant is not wise. While it is important to reprice in a timely manner, doing so without reference to competitive pricing or an underlying pricing strategy can be destructive.

To develop a solid repricing strategy, it is imperative to analyze internal data like marketing, promotions, sales and inventory numbers, and external data like availability and prices of close substitutes, market competitors’ prices, demand, as well as customer feedback data like ratings and reviews. This process of collecting and leveraging datasets for a timely re-pricing strategy is known as Price Optimization.

Why is a Dynamic Pricing Strategy Crucial?

Price Optimization helps you continually price your products competitively at the right time while considering the customer’s willingness to pay, with the end goal of maximizing sales. At the heart of any price, the optimization process requires an analysis of internal and external data to create and optimize a mathematical pricing model. Internal data provides supportive information while external data removes blind spots in your pricing algorithm to allow you to set competitive prices and exploit opportunities.

What are the 4 Reasons Price Optimization is Key to eCommerce Success?

1. Ensure Price Competitiveness

Algorithmic price changes based on various data makes you price competitive over other sellers. Likewise, the process ensures that you are not under priced or over-priced against your key competitors.

2. Boost Sales

Our data indicate that sales at the updated prices increased by an average of 36% within the first 10 days after each price reset.

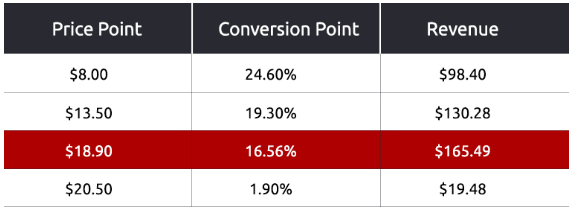

The main purpose of retail price optimization is to optimize prices at the right time to maximize revenue. The process helps retailers utilize dynamic pricing to analyze where they fall within their competitive landscape. They increase prices to maximize profit when possible, all the while reducing prices to boost revenue and sales volume.

Here’s a real-life example: After experiencing intense competition and high price volatility in the market, a leading retailer in Sporting Goods approached us for Price Intelligence Solution. The retailer accepted our price change recommendations we made monthly. Sales for the updated prices increased by an average of 36% within the first 10 days after each reset. Nonetheless, before each following update, revenue decreased steadily from day 10 to day 30.