According to Adobe Analytics, the last ten days of November, including Thanksgiving ($5 billion), Black Friday ($9 billion), and Cyber Monday ($11 billion), generated almost $50 billion in revenue. Rising inflation may have limited shoppers’ spending. However, consumers were determined not to let anything get in their way during this holiday spirit. In 2022, shoppers were still checking items off their shopping lists, looking for ways to stretch their budgets further.

For shoppers- price is almost always a priority. This year was no exception. In fact, its significance was even higher. 60% of consumers mentioned that discounts and promotions play a huge role in their purchasing decisions. However, it would be interesting to see the market’s reaction toward consumer demands during this economic turmoil from products seen by shoppers on Google shopping ads.

To uncover these promotional trends, here at GrowByData – we started to investigate Google Shopping ads across four major categories– Apparel & Accessories, Furniture, Health & Beauty, and Wine & Liquor. Our focus was to understand pricing, SALE, and Special Promotional trends offered by retailers to lure consumers seeking better deals using our Google shopping data across thousands of keywords and categories.

Our three key findings on promotions and discounts offered on Google Shopping ads this holiday season are:

- Sellers responded by continuing to drop the average pricing on ads they were showing shoppers.

- Retailers seemed keen on clearing stocks

- Special promotions fluctuated ( but the sellers did not disappoint shoppers on the main holidays

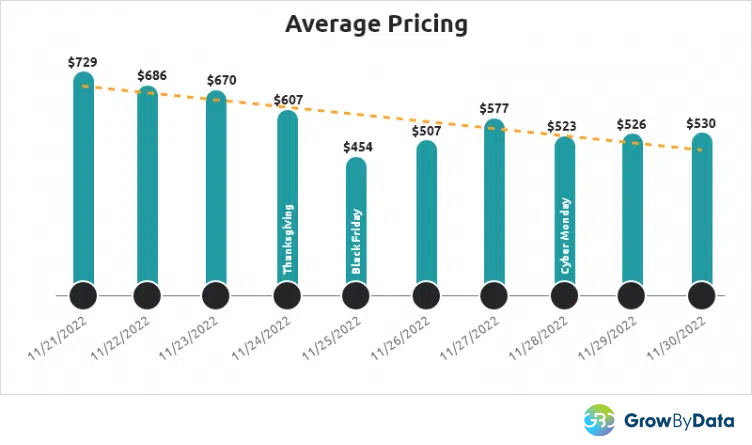

Shoppers Saw Prices Continue to Drop

Believe it or not, the average price seen by shoppers on Google Shopping ads was drastically lower after Thanksgiving. For instance, the lowest average prices were seen on Black Friday. The graph below shows retailers trying their best to lower prices on their Google Shopping products to convince shoppers to buy.

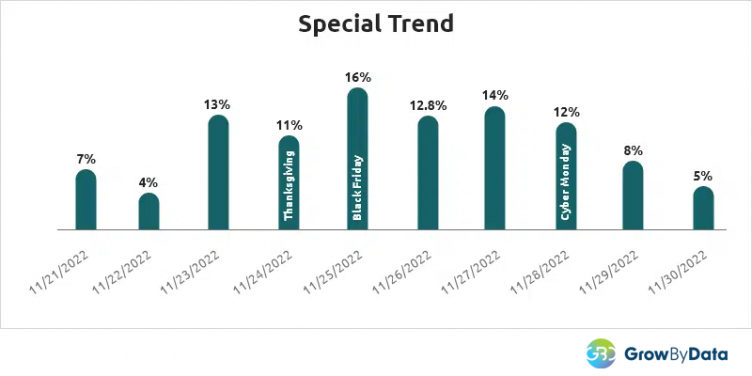

Retailers getting Keen to clear their inventory

During these ten days in November, shoppers were offered around 12.5% of SALE ads. Amongst these, Thanksgiving, Black Friday, & Cyber Monday had the highest percentage of SALE ads.

Per our insights, black Friday had the highest SALE ads at 17% while Thanksgiving and Cyber Monday had about 14%.

Sellers didn’t disappoint Shoppers on Holidays

Compared to the SALE tag, retailers were inconsistent in terms of providing special offers. However, consumers weren’t disappointed on the main days. The graph below shows that promotions were seen drastically increasing on Thanksgiving eve and remained high till Cyber Monday. Not surprisingly, there was a quick decline after the Cyber Monday sale.

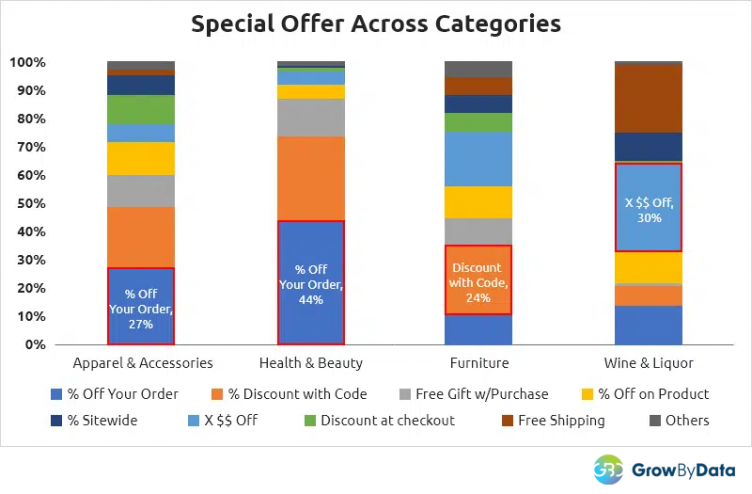

Promotional Strategies across Categories

Going further, there were different types of special offers popular in each category. Shoppers would frequently find ‘% Off Your Order’ promotions in categories like Apparel & Accessories and Health & Beauty, while ‘Discount with Code’ and ‘X $$ Off’ were the most common in the Furniture and Wine & Liquor categories respectively.

For Apparel and Health categories, -the widely used strategy was giving discounts on the ‘whole’ order – perhaps to maximize basket size. For Furniture and Wine categories, discounts were seen only on specific products.

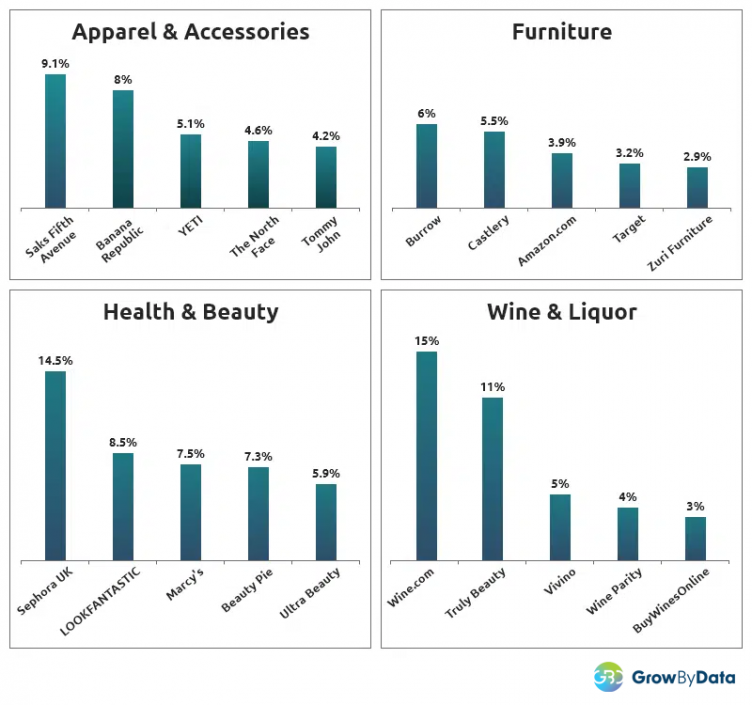

Top Sellers delighting Shoppers

As a shopper, we are always curious to know the maximum discount and promotions sellers are providing during the holidays.

Per our analysis, here are the top five retailers and brands that had the highest number of ads with special offers during the last ten days of November.

Looking ahead into December

With recession looming and shoppers demanding more discounts, retailers are facing tremendous pressure to maximize their Sales with good Profit Margins.

Our data indicate that retailers were reluctant to use flat sitewide discounts. Instead, they preferred promotional strategies to maximize sales. Furthermore, retailers with access to competitive promotion intelligence gained an edge by maximizing their sales and promotional trends, and offers, ultimately winning more market share.

Based on our Google Shopping data, it is fair to say that retailers have responded well to consumer demands for discounts and special offers so far. Moreover, they have managed to attract shoppers to buy during the holiday season despite the tough economy.

However, they must keep in mind that the holiday season is not over yet and that they must continue to provide the best deals to lure shoppers that have been waiting to buy. In Summary, this competition amongst retailers will also benefit the shopper since retailers will most likely offer better deals to gain market share and clear inventory at the end of this holiday season. This should benefit shoppers as they will find more discounted products to complete their shopping list without breaking the bank for brands and retailers, it is imperative to stay on top of using promotion intelligence to be on top of competition and shopper trends.