Why is Amazon your biggest competitor on Google? And how can your Search Teams tackle the Persistent Amazon Threat?

Believe it or not, in today’s shopping world, 59% of consumers begin their shopping journey on Google. Amazon recognizes the importance of Google on its e-commerce business and spends tens of millions on the search platform every year.

Table of Contents: Show

Amazon is amongst the top advertisers on Google. Not only that, but they are also the number one competitor in almost every category with a massive marketing budget almost unmatchable to most advertisers. They can boost their visibility by increasing ad spend whenever necessary.

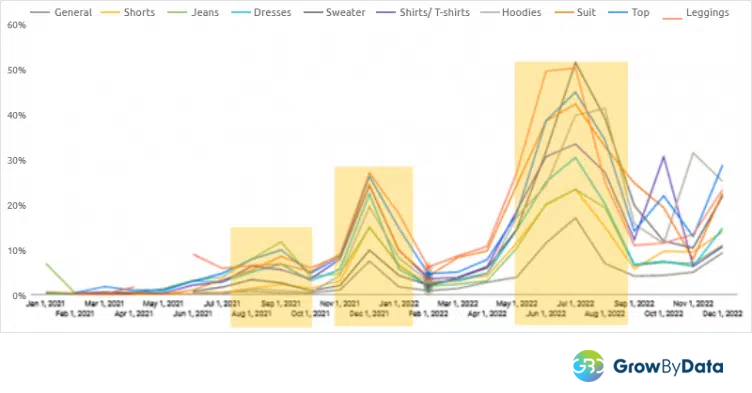

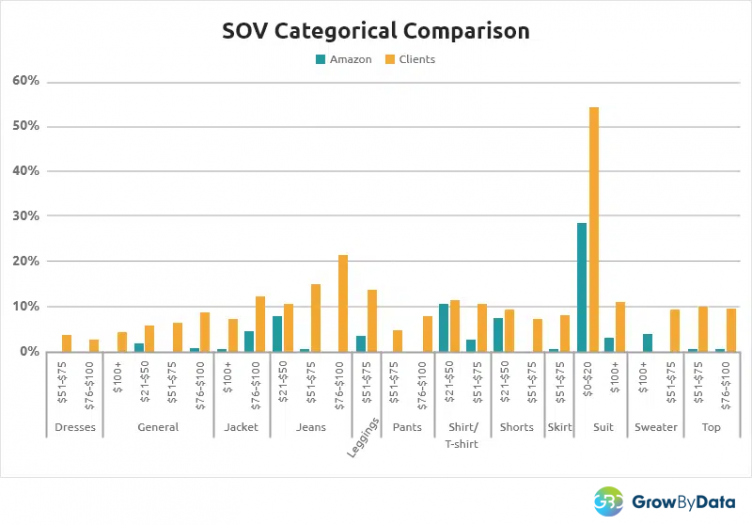

The graph below shows the power of Amazon to swing their visibility on Google shopping ads across different apparel and accessories product types.

That said, it is fair to say that advertising without visibility into Amazon’s search tactics will lead to a lower return over ad spend (ROAS).

For example, our apparel client learned their ad visibility improved over a period when Amazon’s Share of Voice (SOV) was decreasing and vice versa.

So, how can Search Marketers better compete with Amazon on Google SERP?

Competing against Amazon’s limitless resources, budget, and brand name may seem daunting. However, there are 4 tactics to gain top search performance despite Amazon’s dominance –

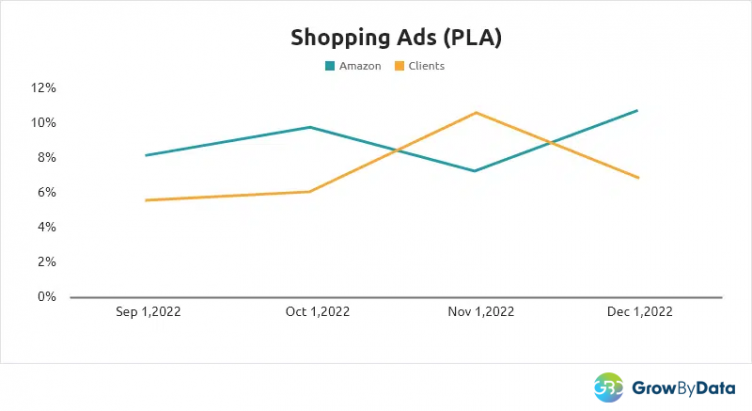

First off, Search Marketers should understand Amazon’s tactics across SERP features. Looking at Amazon’s Share of Voice (SOV) trend in our client’s competitive landscape across Shopping Ads and Text Ads in the graph below, it is evident that Amazon has the power to increase its paid ads per their wish. SEM team should be constantly monitoring such tendencies and make informed decisions to address such threats to their advertising. The easiest decision for paid advertisers is slow their advertising campaign in segments where Amazon is strong and remobilize their ad budgets to where Amazon is weak.

In the section below, we emphasize the importance of SEM teams in identifying opportunities when Amazon becomes aggressive on Google Paid Ads. However, as a part of their long-term strategy, the search team must consistently look for opportunities to optimize across organic SERP Components – especially the ones rising above the fold. To compete with Amazon’s tough paid ads competition, doing SEO is an excellent tactic. That said, search marketers must monitor and analyze opportunities in different organic SERP features.

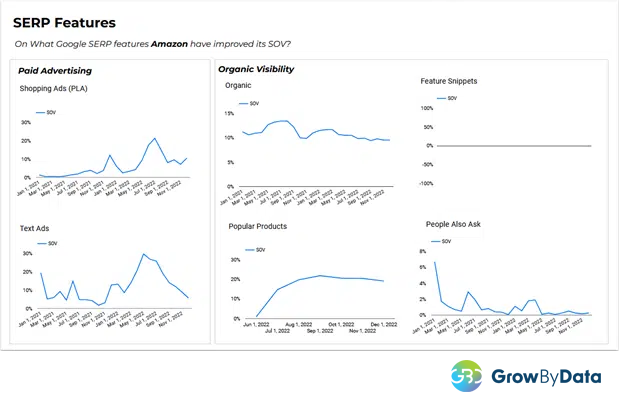

As shown in the graph below, Amazon has a weakness in Organic Visibility. These types of insights, unified with Google Market Pulse can help marketers strategize and prioritize their activities to win more organic share in Google SERP. From the chart below, we can see –

- Amazon Organic SOV is in a downtrend trend

- Amazon has zero coverage in Featured Snippets

- SOV in Google Popular Product – that once spiked, is now dropping

- Amazon has not been strong in People Also Ask and is gradually losing here

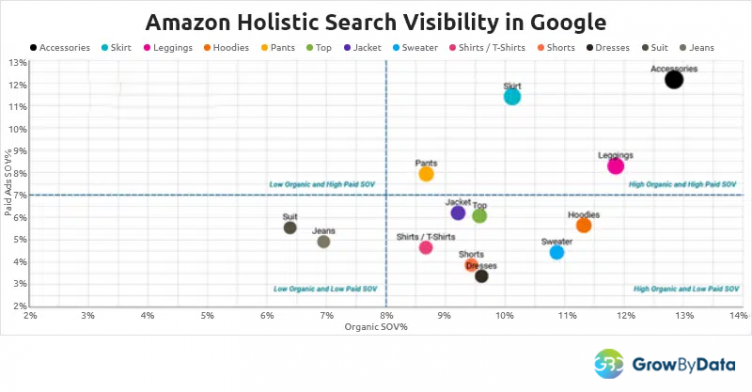

A key task any search marketer must do is measure Amazon’s Holistic Search visibility across various product segments. Looking deeper at the chart below, the Apparel category keyword landscape shows Amazon having good organic SOV (Sum of Visibility of Organic, People Also Ask, and Popular Products) across all product types. But it has lower SOV in the Suit and Jeans category. Therefore, this segment could be a priority area for the SEO team to win business from Amazon.

Additionally, SEM teams can allocate ad dollars to product groups like Shorts, Dresses, and Sweaters where Amazon has lower Paid Ads (Sum of Shopping and Text Ads) Visibility.

It is imperative to understand the types of product segments and price strategies Amazon is pushing on Google Ads during different times of the year. This approach plays a crucial role in providing insights into consumer demand and shopping trends. For example, if Amazon is heavily promoting shorts and summer clothing during spring and early summer, it is indicative of Amazon reacting to consumers’ thinking about the upcoming warm weather and searching to prepare their summer wardrobes.

Monitoring and analyzing Amazon’s Google shopping ads at a yearly, seasonal, and hourly level by product category offers insights on how Amazon is increasing or decreasing its ad dollars on high-growth segments. And importantly, by understanding activity by product segments by pricing tiers, marketers can identify opportunities to push their ads and ultimately win market share! A simple strategy even during Amazon’s aggressive period is – to push ads in high-demand pockets where Amazon’s visibility is low.

The graph below shows apparel product segments by pricing tiers – a helpful view to uncovering where Amazon is weak. We can see Dress and Tops have opportunities. By focusing on such segments, search marketers can get top performance even during Amazon’s high ad spending period.

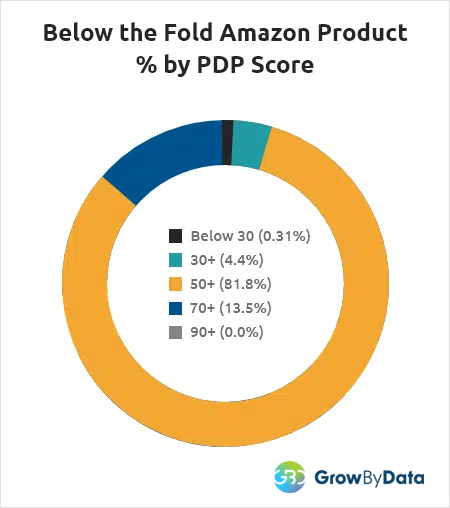

It is fair to say that if you are competing with Amazon on shopping ads, your search marketing team must analyze and spot your weakest Amazon ads and Product Detail Pages (PDPs). Say your ad quality is weak and your PDP score is low. This means you have a low keyword quality score, which demands very high bids to win good ad spots in Google. On the other hand, if you have a better quality score in any keyword, you can compete and most likely win market share with lower Ad Spend.

Per our analysis of Below the Fold Amazon ads in Google Shopping (ads with a rank higher than 5), we noticed that none of the products with a PDP score of more than 90+ had an ad rank greater than 5. From this, we can infer that Amazon’s best PDPs easily acquire the top spot i.e., above-the-fold coverage in Shopping Ads. And when Amazon is spending high, they are simply unmatchable. However, Amazon products that have a poor score below 30 (0.31%) struggle to get an impression even below the fold of real estate.

This means – search marketers must focus on competing with Amazon’s products with weaker product experience. By doing so, you have the chance to beat them with a lower cost per click presuming that you have a better keyword quality score. Therefore, for any search marketer, it is important to measure and compare your product experience with Amazon and mobilize the budget to segments with such products to win market share from Amazon.

Search marketers face ultra-competition from Amazon. By deeply understanding this approach of tracking SERP tactics on Google, marketers can identify opportunities on SERP features and keywords, product segments, and price points to improve Google Share of Voice (SOV) and better compete with Amazon. Moreover, by carefully coordinating across paid and organic listings, search marketers can pursue a holistic search strategy to maximize performance.