At GrowByData, we analyzed Amazon’s spending on Google Shopping Ads during July 2023 Prime Day and compared it to the 2022 versus 2023 Share of Voice trends. We found that Amazon dominated Google Shopping Ads during July 2023 Prime Day. However, we noticed a drop in Amazon’s domination in 2023 Prime Day versus 2022 across a few categories. This is an intriguing development that demonstrates potential opportunities for other brands competing with Amazon. In this blog, we’ll delve into Amazon’s Share of Voice (SOV) trends across various industries in 2023 & compare them to Amazon SOV in 2022.

1. Amazon’s Changing SOV on Prime Day

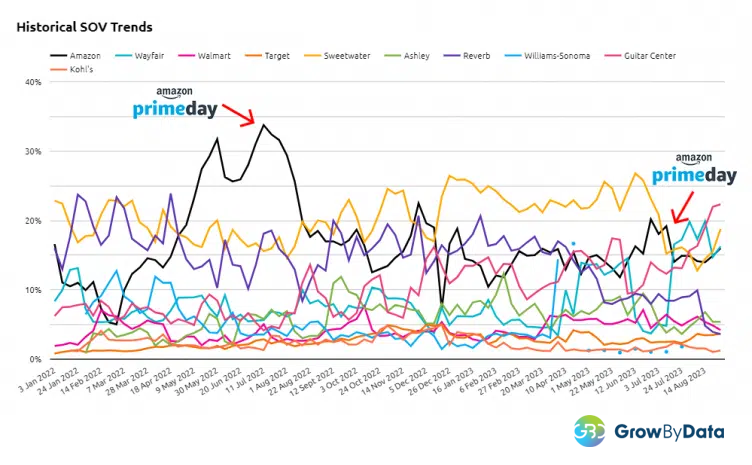

Analyzing the graph below, we noticed a shift in Amazon’s Share of Voice (SOV) during Prime Day. Unlike last year’s Prime Day, where Amazon’s SOV ranged between 35% and 40%, this year’s Prime Day has witnessed a significant decrease, with the current SOV ranging from 25% to 30%. This indicates a shift in Amazon’s competitive landscape, potentially influenced by increased competition shifts in consumer behavior or pressure on Amazon’s ad budget.

From the graph, we can see Amazon dominated Google Shopping Ads during the July 2023 Prime Day. We know Amazon will likely ramp up again during the 2023 Black Friday, Cyber Monday, and Christmas holidays. In light of this, to maximize sales and margins during upcoming holidays, brands must monitor Share of Voice across geographies and categories, and watch out for Amazon and other competitors to plan spending around them and consumer demand. To maximize ROI during these key shopping events, brands should update their product feeds to increase Quality Scores and reduce CPCs.

With SOV insights, brands should take advantage of Amazon’s reduced spending post-Prime Day or other holiday events, when CPCs (cost-per-click) decline and capture consumer demand. However, brands should be prepared for Amazon to offer its own post-Prime Day discounts. To remain competitive, brands should consider promoting their own offers. Below, we’ll provide details of Amazon’s Share of Voice (SOV) trends across various industries in 2023.

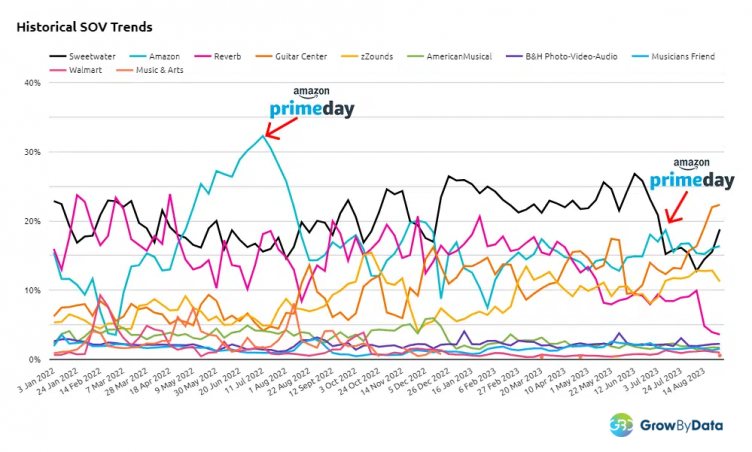

2. A Closer Look at the Music Industry

Amazon secured a commanding 32.28% SOV in the music industry on Prime Day with Sweetwater competing with 15.57% SOV. However, in 2023, Sweetwater consistently outperformed Amazon throughout the year leading up to Prime Day. Nevertheless, there was a noticeable turning point during Prime Day, as Sweetwater experienced a sudden decline in SOV, allowing Amazon to briefly regain the lead with 18.66% of the SOV. This suggests a more competitive atmosphere in the music industry during Prime Day, with both Amazon and Sweetwater vying for consumer attention

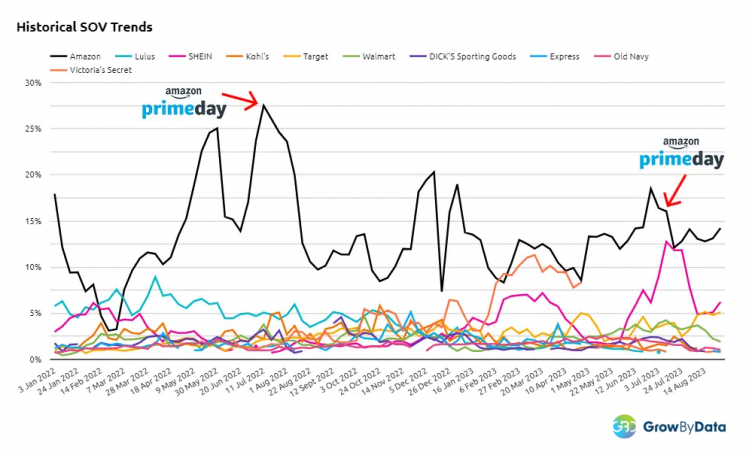

3. Dynamics in the Apparel Sector

The apparel industry also witnessed significant changes in SOV trends. In 2022, Amazon enjoyed an overwhelming 27.48% SOV on July 11, leaving very little room for competitors like SHEIN. However, 2023 tells a different story. There has been a substantial decline this year, with the SOV dropping to 16.04%. Amazon’s SOV while SHEIN made substantial gains securing 12.76% of the SOV. This highlights how competition in the Apparel industry can reshape the retail landscape in a relatively short span.

Conclusion

These Share of Voice (SOV) trends observed during 2023 Amazon Prime Day across industries offer valuable insights into the ever-evolving competitive dynamics of e-commerce. Amazon, while still a dominant force, faced more competition on Prime Day. In particular, the music and apparel industries have seen significant shifts, with companies like Sweetwater and SHEIN emerging as formidable players.

Looking ahead, as Amazon and its competitors adapt to these changes, consumers may see more offerings and better deals during future Prime Day and upcoming 2023 holiday events. For brands, e-commerce remains a revenue growth opportunity. And monitoring SOV on Google Shopping offers a nice window to stay on top of this ever-evolving landscape.