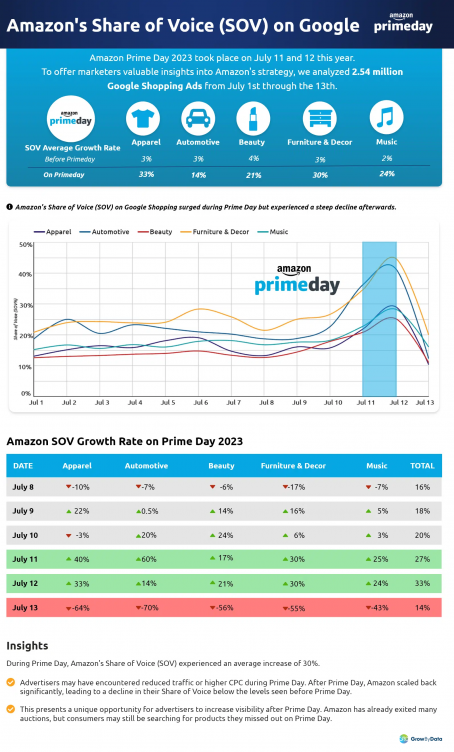

Prime Day (2023), the highly anticipated annual shopping event, ran from July 11th through July 12th this year, and we have the receipts of Amazon’s heavy spending on Google Shopping ads.

We tracked the SERP and analyzed over 2.5 million Google Shopping Ads, across 3,500 keywords and 5 verticals from July 1st through the 13th. Our analysis uncovered valuable insights to help digital marketers plan for Amazon’s next push on Black Friday and Cyber Monday.

Additional Reading: Amazon October 2023 Members-Only Prime Day: Google Shopping Share of Voice

Key Findings

✔ Amazon’s Share of Voice (SOV) on Google Shopping increased significantly during Prime Day, especially in the Automotive and Apparel categories.

✔ All verticals saw significant SOV growth during Prime Day, averaging 35% on July 11 and 24% on July 12.

✔ In the Automotive category, Amazon’s SOV rose to 36% on July 11, representing a 60% market share lift.

✔ In the Apparel category, Amazon’s SOV on July 11 was 22%, up from 16% the day before, showing a 40% market share gain.

✔ Furniture and Décor also experienced notable SOV gains, capturing 35% and 45% of the market on July 11 and 12 respectively.

✔ After Prime Day, there was a significant decline in SOV across all industries, averaging a 59% decrease. Amazon even pulled back to pre-Prime Day levels.

✔ Amazon reduced ad spend by 70% in the Automotive Industry and 64% in the Apparel industry following Prime Day.

Implications

Amazon is a powerful force in Google Shopping Ads during Prime Day. Brands that want to maximize the impact of their marketing dollars can choose from a variety of strategies to maximize ROI, including making sure that all sale annotations in their feeds are up to date, or even look at taking advantage of Amazon’s reduced spending right after Prime Day to come in and capture Share of Voice when CPCs will most likely fall. Of course, Amazon may have taken the opportunity from brands to gain revenue lift after demand is satisfied. It is worth considering countering this with messaging to consumers that you will be offering post-Prime Day discounts that could/will exceed what Amazon had to offer.

Consider taking a deeper dive into your metrics, and data that can be extracted directly from the Google Shopping Ads panel, to plan for the upcoming holiday season.

GrowByData Google Shopping Monitoring can collect custom data for your needs to help with strategic sales planning.

Feel free to connect with one of our data and insights experts here. We love talking about data and digital marketing strategy!