Amazon has closed the books on its two Prime Day promotions in 2023. In July, Amazon ran its annual sale, which is open to everyone, and its exclusive members-only event in October.

The July sale generated $12.7 billion for Amazon over the course of the two-day event, representing a 6.1% increase from the July Prime Day 2022.

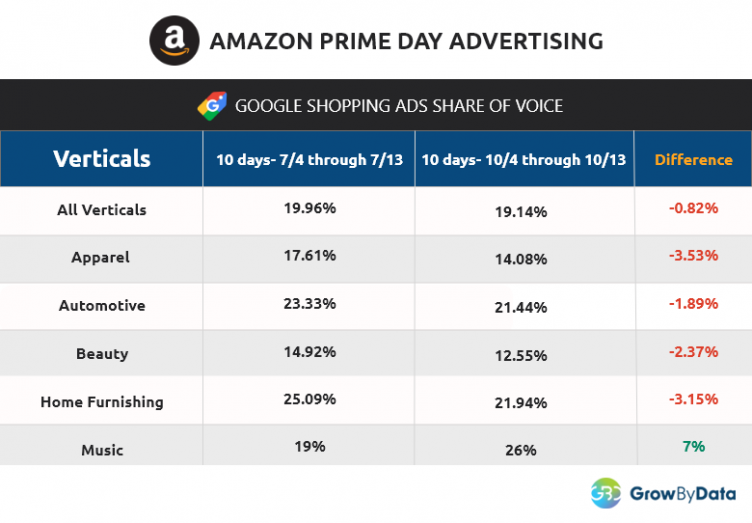

In July, we published insights into Amazon’s aggressive push in Google Shopping, where the dominant e-commerce company pushed from its baseline of capturing a 20% Share of Voice (SOV) of all Google Shopping Ads, to a peak of 35% SOV during the event.

In this article, we dive into Amazon’s takeover of Google Shopping during the October members-only event and compare the campaign to July’s Prime Day after we monitor google shopping over the course.

Why Does This Matter?

Brands can increase their Return on Advertising Spend (ROAS) by deciding when to drive competitors to their own e-commerce platforms and when to boost ad spend on Amazon.

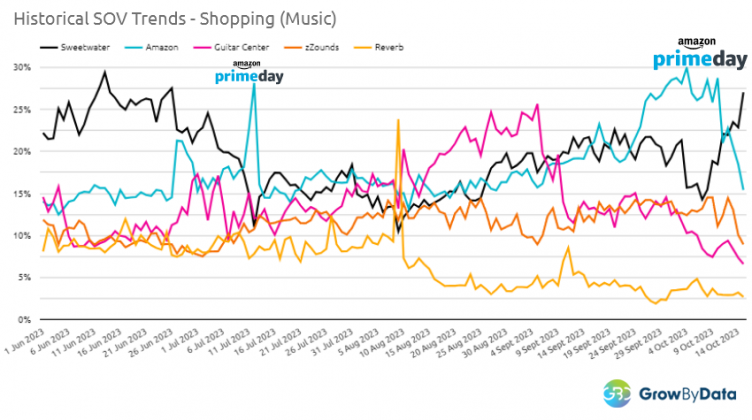

Amazon’s Chooses to Push Hard in the Music Industry in October

During the two Prime Days on October 11 and 12, Amazon had a peak share of voice at 26%. This upward trend began in late September and hit its high point on October 4th at 30%.

Notably, the only category where Amazon increased its SOV from July to October is the musical instrument category, where it captured +7% SOV from one period to the other.

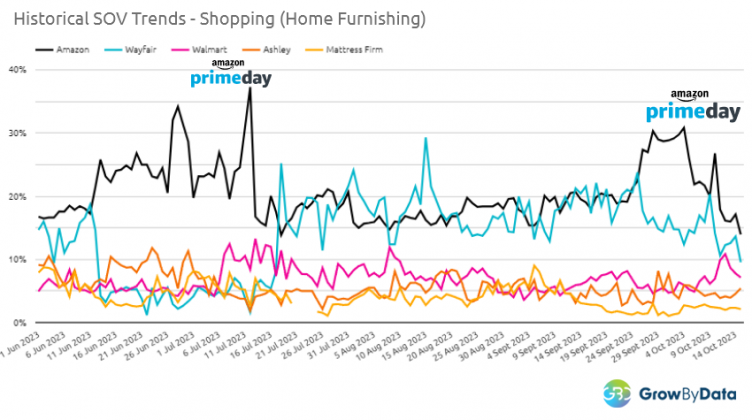

Home Furnishings: Amazon Knocks Out Wayfair

Amazon reduced its Google Shopping ad spend in the Home Furnishings category in October vs. July.

However, Amazon was successful in pushing out Wayfair, a traditional leader in Google Shopping in the furniture category, during both events.

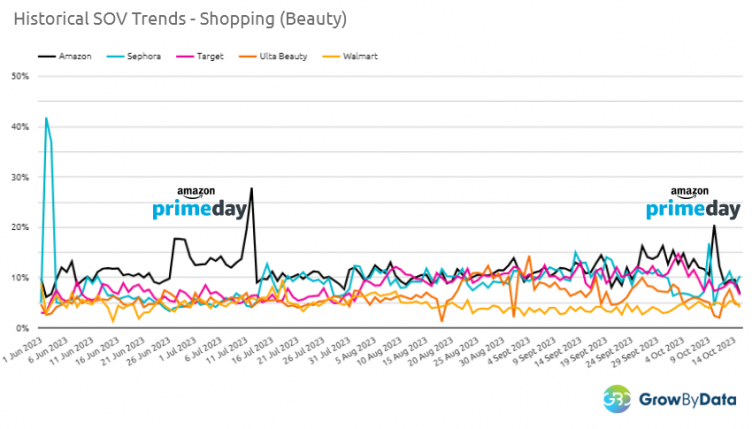

Navigating the Beauty Category: Domination in July and a Crowded Field in October

In October, Amazon reduced its focus on the beauty category in comparison to the July event. In July, Amazon created a wide gap vs. the competition, while they had a more modest spike (and shorter duration) vs. the competitive field.

Sephora made a short push in October to counter Amazon’s increased spend.

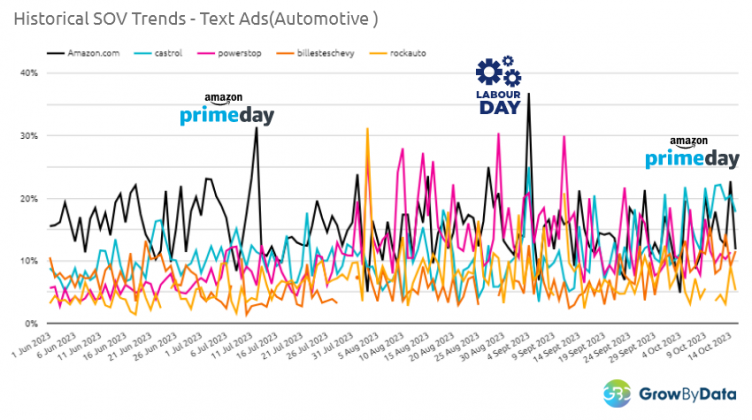

Automotive Industry: No Clear Winner in October

Amazon’s market share in the Automotive industry during the October 11 and 12 events was noticeably flat compared to the space it opened up vs. the competition in July.

Amazon clearly saw an opportunity on Labor Day, where they chose to focus instead of the October Prime Day sale, reaching a peak of 37%, SOV.

Conclusion

Brands can prepare for Amazon’s flagship pushes to capture demand by observing historical and current trends in their category. As the Prime Day events continue to evolve, understanding these trends becomes increasingly crucial for businesses and marketers seeking to leverage Amazon’s platform effectively.

Learn more about how you can use GrowByData Search intelligence to gain a competitive advantage: